Commercial Solar

Solar for your business – the greatest investment you can make.

The Benefits Of Commercial Solar Are Even Better Than For Residential Solar

You still retain the 26% Federal tax credit but you also gain:

- 5-year depreciation schedule

- 100% Year 1 depreciation

All this adds up to double-digit rates of return and cash payback periods in the 4-6 year range.

Let us assess you bill and available space to see how much we can offset for you.

If you have a roof that is catching sunshine, let us put solar modules up and help you realize your roof's full potential

We can install solar at the very best value on your building. Everything is in place to give you the very best price: flat unobstructed roof; electric service readily available.

And solar on your roof will drive more customers to you. Whether they are just curious or only desire to do business-to-business with companies that share their values, you will find that solar pays off much more than the direct energy savings and tax credits you gain.

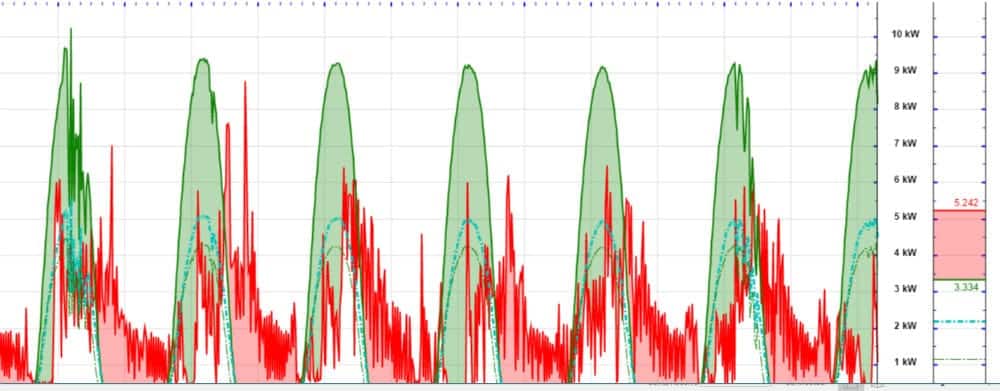

We pair our commercial systems with "whole-building" monitoring so you see what you generate and what you use

We can model what you’ll generate with great accuracy.

But knowing what you USE is just as important.

We install eGauge systems on all of our commercial jobs because you NEED to know what is using power and when you’re using power.

Our customers shift load profiles to match up with solar generation to reduce peak demand charges. That equals big savings.

They also can identify the large energy users in their buildings and make future investment decisions to further reduce consumption and increase the contribution of solar power.

Tell me more about the additional tax benefits

Your system now has a 1-year depreciation schedule and that means fantastic tax benefits for you.

The IRS deems that the system depreciates in a single year…even though you have a system with 25-year warrantied panels and a 10-25 year warrantied inverter.

All this with the 26% Federal tax credit means solar is an amazing investment for you.

YES – it can really be this good.

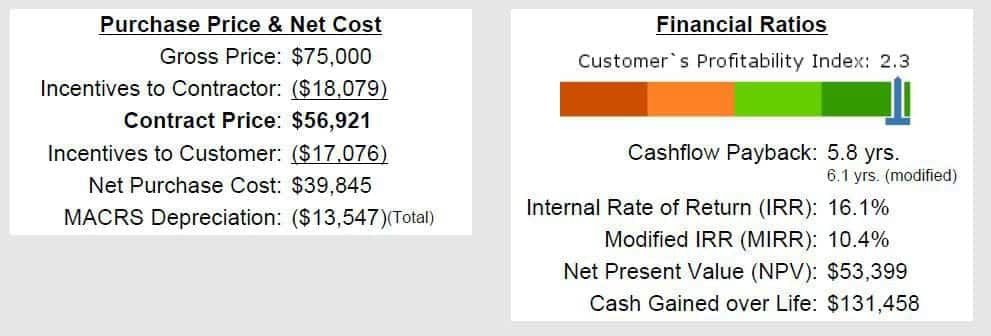

Here is a medium commercial system that starts at $75,000

The Oncor incentive reduces your contract price to $56,921.

You’ll receive a 30% tax credit of $17,076 when you file next year.

Over five years, the present day value of the 5-year depreciation is another $13,547.

This means that our customer is paying a net cost of $26,298 over five years for a system that will generate (in has case) about 80% of his electricity.

We will find every possible incentive and grant

We are authorized service providers in Oncor, AEP, TNMP and that means we can access commercial incentive funds to reduce your cost. We handle everything.

For many, we can compete for USDA Renewable energy grants, too.

Not just for farms and agriculture, the USDA grants are for small business in rural and we can quickly assess your eligibility for this grant, which is for 25% of the total cost.

Yes – you can have the 26% tax credit, the USDA grant, the utility incentive, and one year depreciation all for the same project. And the best way to represent the value of this is to say that solar is like having 4-5 cents per kwh electricity – forever!